Tech

6 Things You Must Do To Protect Your Bank Account From Cyber Criminals

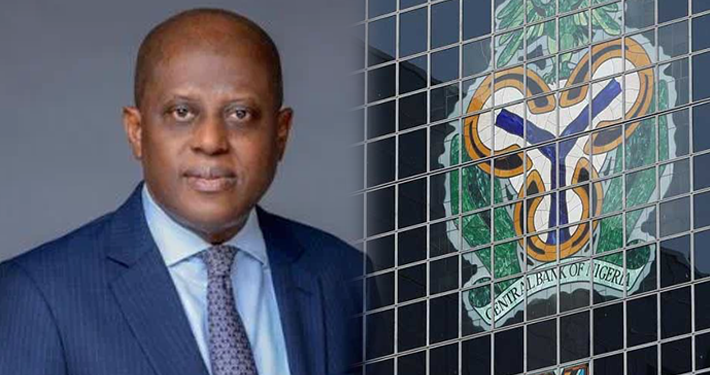

A few years ago, the Central Bank of Nigeria introduced the “Cashless Economy” policy into the Nigerian banking system. The aim is to migrate regular banking transactions to Online and Mobile banking. Consequently, the USSD code and Mobile App banking came into play.

USSD service enables customers to perform fund transfers, check balances, check BVN(Bank Verification Number) and airtime recharge just by dialing a code on their mobile phone just as can be done using the bank’s smartphone app.

EDITOR’S PICK:

-

5 Foods That Can Reduce Anxiety Instantly

-

3 Warning Signs Of Diabetes You Must Never Overlook

-

5 Bad Signs You Are Not Eating Enough Food

The Cashless Policy and the services that came with its implementation have no doubt made banking so simple and easy for Nigerians. However, like every other new technology, they also came with some challenges.

Although these challenges otherwise called risks may not be seen as inherent in the system or its implementation as most of the risks arising from misuse of the infrastructure

In this article on EKO HOT BLOG, we would be looking at some things you must know you protect your bank account from cybercrime.

1. Do not share your PIN with anyone

Many people, out of impatience find it wise to hand over their ATM cards to others to help them make withdrawals whenever there is a queue at the ATM spot and in the process share the entire details of their Debit card with another person including their secret PIN. This is highly risky viewing it from Cyber Security perspective. It renders your account vulnerable to attack.

2. Do not use easy-to-guess numbers as PIN

Never use your birth year, the last four digits of your phone number, numbers like 1234, 4321, 1111, 4567 or the year in which the card was issued as your pin. These are all very weak and easy to guess. We should indeed use a number we can easily remember, however, using a weak PIN is equivalent to locking a door with a padlock that can be opened by different keys.

3. Do not give your phone to strangers

It may be tempting to help a stranger by giving him/her your phone to make a phone call, but that single act of charity may turn out to be a fatal mistake if you fail to monitor them as they make use of it. This is because cybercriminals to hide in such disguises to steal vital information that can be used to easily hack your account.

4. Never send an OTP to someone over the phone

Most banks require a One Time Password (OTP) received via SMS or generated by a hardware token to authorize most online transactions. Never respond to any request to send such code to anyone over the phone even if the request claims to come from your bank.

5. Report any loss of your ATM card to the bank immediately

You must report to the bank immediately you discover that your ATM card is missing and instruct them to invalidate the card. This will mitigate the risk of losing your sweat to a Cyber Criminal.

FURTHER READING

-

3 Warning Signs Of Diabetes You Must Never Overlook

-

Must Read: 5 Dangerous Signs That Indicate Your Body Is Unhealthy

-

Revealed: How To Get Back Your Money From Scammers (6 Easy Steps)

6. Protect your SIM card with a pin

Due to the risky nature of *904#, the code used to purchase MTN OnDemand Airtime recharge, it is advisable to lock the SIM card (if it is MTN) associated with your account number with a PIN. This will help keep your account if your phone is lost or stolen.

Click to watch our video of the week

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611