Tech

3 Simple Ways to Identify A Fake Bank Credit Transaction

EDITOR’S PICK:

- SCAM ALERT: 4 Ways Your Bank Account Can Be Hacked By Internet Fraudsters

- 7 Best Spy Apps To Catch A Cheating Partner

- 5 Weirdest Cars You Would Not Believe Actually Exist

The fake credit alert scheme is one technique that has been used by fraudsters to swindle people of their money, goods and services in the last two decades, and it is still very much used today.

Studies have shown that a good number of people have fallen for this gimmick of the fake credit alert scheme, while many others are still falling victims due to the lack of awareness in this area.

In this article on EKO HOT BLOG we would be looking at ways to identify fake bank credit transaction.

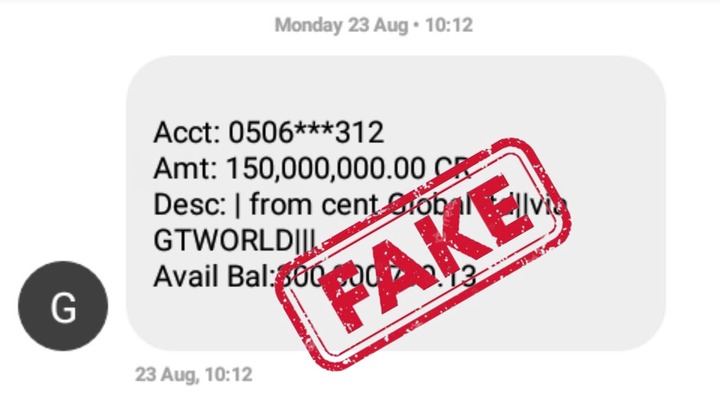

1. Your bank account will not be credited

When your bank account is credited, it reflects instantly in your account which is revealed in the increase of figures. But a situation where a credit alert is supposedly reflected on your phone’s inbox message, and it doesn’t alter the available balance in your account, such a transaction or alert can be tagged as a fake one. A credit alert comes with an automatic increase in the available balance.

2. The fake alert does not show your available balance

Another way a fake credit alert can easily be spotted is by checking the available balance column on your alert message. When a credit alert doesn’t reveal the money you have left in your saving, it is obviously a fake transaction and should attract the attention of the appropriate authorities.

3. There is usually no trace of the transaction in your email

When a bank financial transaction is made – whether a credit or debit transaction, it is usually sent to your email inbox, most especially when your email was used in registering the account. When a credit transaction is made, and it wasn’t delivered to your email inbox, such an alert is suspicious and must be probed.

FURTHER READING

- 3 Warning Signs Of Diabetes You Must Never Overlook

- Drivers: 5 Mistakes You Must Never Make While Driving An Automatic Car

- Revealed: How To Get Back Your Money From Scammers (6 Easy Steps)

The proof of transactions is usually sent to the customer’s email by the bank for the sake of record keeping and validation.

Click to watch our video of the week:

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611