News

‘It Is Illegal’ – Falana Tackles CBN Over Cash Withdrawal Limit Policy

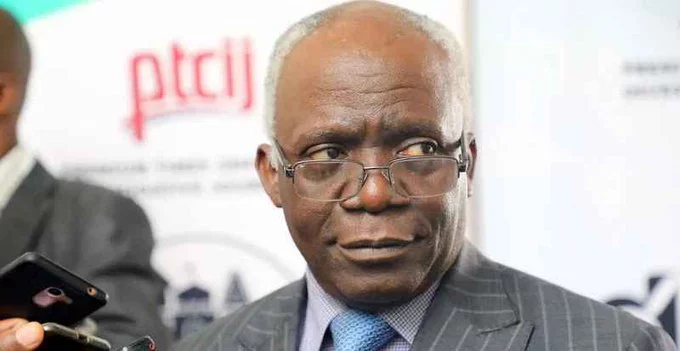

Falana has tackled CBN over the cash withdrawal limit policy.

EKO HOT BLOG reports that a Senior Advocate of Nigeria (SAN), Femi Falana, has tackled the Central Bank of Nigeria (CBN), saying the bank’s recent reintroduction of the cash withdrawal limit is illegal. The human rights lawyer argued that the policy was illegal because the Money Laundering Act 2022, which has fixed maximum cash withdrawal to N5 million, has not been amended.

This online media platform gathered that Falana, in a statement on Monday, explained that on that premise, it would be illegal for CBN to fix daily and weekly cash limitations to N20,000 and N100,000, respectively. He said it was also illegal for CBN to order Deposit Money Banks (DMOs) and other financial institutions to ensure that weekly over-the-counter (OTC) cash withdrawals by individuals and corporate entities do not exceed N100,000 and N500,000, respectively.

EDITOR’S PICKS

-

2023: Tinubu Meets South West Muslim Leaders In Oyo

-

List Of Top PDP Chieftains At Abuja Presidential Rally (Photos)

-

APC Women Leader Causes Stir After She Was Spotted At Shiloh2022

His reaction follows the release of a memo issued by the apex bank last Tuesday fixing daily and weekly withdrawal limits to N20, 000 and N100,000, respectively.

The memo signed by the CBN’s Director of Banking Supervision, Haruna Mustafa, reveals that withdrawals above the thresholds would attract processing fees of 5% and 10%, respectively, for individuals and corporate entities going forward. It also said third-party cheques above N50,000 shall not be eligible for OTC payment while extant limits of N10m on clearing cheques still remain.

The circular also directed banks to load only N200 and lower denominations into their ATMs and restricted withdrawal to N20, 000 per day from ATMs.

However, Falana, in the statement he titled “Maximum withdrawal limit is N5m in Nigeria” advanced that it was rather embarrassing that the CBN has been making announcements without any regard to the constitution and other relevant laws on the national economy.

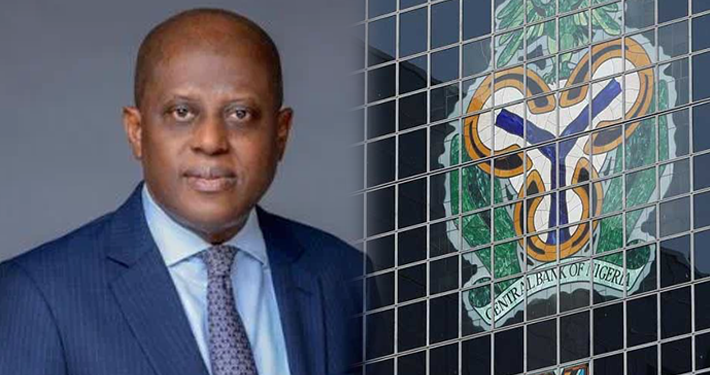

He further noted that it is particularly worrisome that the CBN Governor, Godwin Emefiele, has purportedly placed a limitation on cash withdrawals in Nigeria in complete defiance of the Money Laundering Act.

While making reference to section 2 of the Money Laundering Act, 2022 the human rights lawyer stated that “2. (1) No person or body corporate shall, except in a transaction through a financial institution, make or accept cash payment of a sum exceeding (a)N5,000,000 or its equivalent, in the case of an individual or (b) N10,000,000 or its equivalent, in the case of a body corporate.

“(2) A person shall not conduct two or more transactions separately with one or more financial institutions or designated non-financial businesses and professions with intent to (a) avoid the duty to report a transaction which should be reported under this Act and (b) breach the duty to disclose information under this act by any other means.”

He there called on President Muhammadu Buhari to direct the management of the CBN to withdraw the illegal guideline, which is set to take effect from January 9, 2023.

FURTHER READING

-

Election: What APC Must Do To Emerge Victorious In 2023 – Buhari

-

Chaos In Enugu As Gunmen Attack Market, Burn Down Police Vehicle

-

Fuel Scarcity Lingers As DSS 48 Hours Deadline Elapses

Falana also urged the CBN to stop further announcements of more policies that are designed to sentence poor citizens to more excruciating economic hardship.

Click to watch our video of the week

https://youtu.be/TvfUrim3tysa

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611