News

CBN Tightens Financial Grip, Banks Brace For Capital Boost

-

CBN introduces new capital requirements for Nigerian banks to bolster sector resilience.

-

Commercial banks with international authorization must now have N500 billion capital.

- Non-interest banks need to meet capital thresholds of N20 billion (national) and N10 billion (regional).

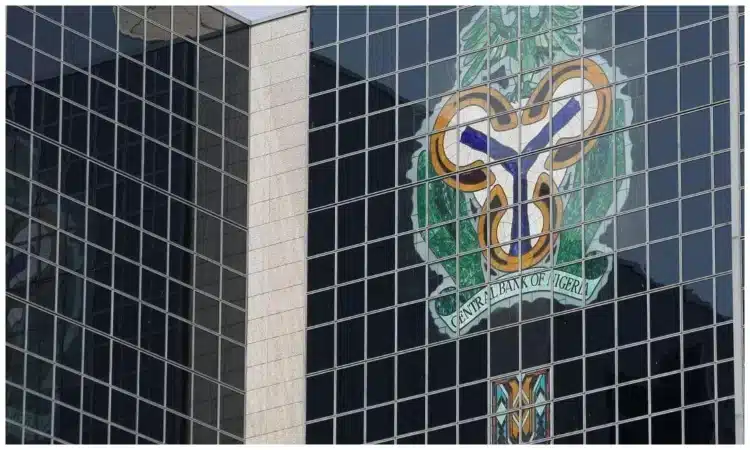

Eko Hot Blog reports that in a move aimed at fortifying the Nigerian banking sector, the Central Bank of Nigeria (CBN) has unveiled stringent new minimum capital requirements for commercial, merchant, and non-interest banks operating within the country.

This decision, according to the apex bank, is a strategic response to the prevailing macroeconomic challenges and headwinds stemming from both external and domestic shocks.

Editor’s Pick:

- FG Begins New Expatriate Job Policy, Violators Risk N3m Fine

- Price Of Block In Nigeria As Cement Sells For Over N10,000

- Osimhen Misses Chance To Extend Scoring Streak As Napoli Secures Historic Victory Over Juventus.

As outlined in a statement by the CBN’s Acting Director of Corporate Communications Department, Hakama Sidi Ali, the new capital base for commercial banks with international authorization has been pegged at a staggering N500 billion. Nationally authorized commercial banks, on the other hand, must meet a threshold of N200 billion, while those with regional authorization are expected to achieve a capital base of N50 billion.

The CBN’s directive also extends to non-interest banks, with those operating at the national level required to maintain a minimum capital of N20 billion, and their regional counterparts mandated to hold a capital base of N10 billion.

In a circular signed by the Director of Financial Policy and Regulation Department, Haruna Mustafa, and addressed to all commercial, merchant, and non-interest banks, as well as promoters of proposed banks, the CBN emphasized that compliance with the new minimum capital requirements is mandatory within a 24-month window, commencing from April 1, 2024, and concluding on March 31, 2026.

Quoting the circular, “The move, initially disclosed by the CBN Governor, Olayemi Cardoso, in his address to the Annual Bankers’ Dinner in November 2023, was to enhance banks’ resilience, solvency, and capacity to continue supporting the growth of the Nigerian economy.”

In a bid to aid banks in meeting the new capital requirements, the CBN has urged them to consider injecting fresh equity capital through various avenues, including private placements, rights issues, and offers for subscription. Additionally, the apex bank has recommended exploring mergers and acquisitions (M&As), as well as the option to upgrade or downgrade their license authorization.

Furthermore, the circular clarified that the minimum capital shall comprise paid-up capital and share premium only, stressing that the new capital requirement shall not be based on the Shareholders’ Fund.

The CBN’s directive also extends to proposed banks, with the circular stating that the minimum capital requirement for such entities shall be paid-up capital. Notably, the new minimum capital requirement shall apply to all new applications for banking licenses submitted after April 1, 2024.

Further Reading:

- Military Welcomes Sunday Igboho’s Offer To Combat Insecurity In South-West

- Bella Shmurda Opens Up On The Side Effects Of Smoking Weed

- Oyo LG Election: APC Raises Alarm, Threatens To Withdraw Candidates Over BVAS Controversy

As the Nigerian banking sector braces for this seismic shift, the CBN’s move underscores its commitment to fostering a resilient and robust financial ecosystem, capable of withstanding economic turbulence while driving sustained growth in the nation’s economy.

Click here to watch video of the week

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611