News

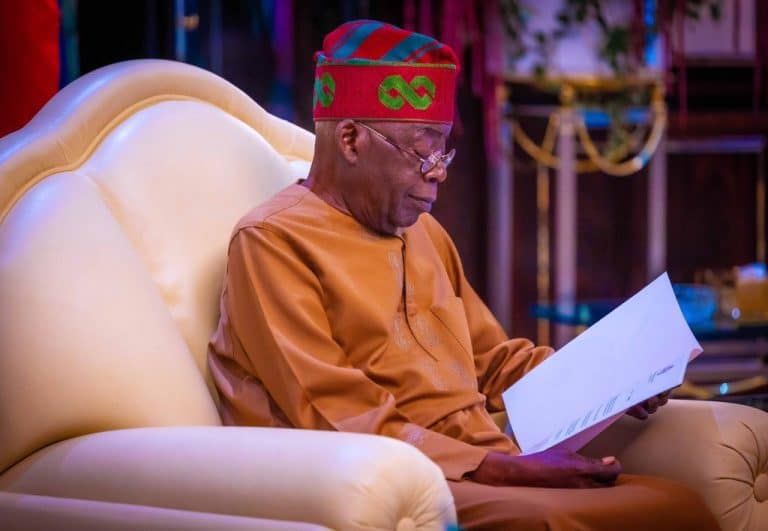

Nigeria’s Debt Under Tinubu: Presidency Releases Crucial Details, Facts

The Nigerian presidency has addressed recent concerns regarding the country’s debt situation under President Bola Tinubu. Contrary to reports suggesting an increase in Nigeria’s debt, the presidency revealed that the nation’s debt stock actually fell by 15% in dollar terms during the first quarter of 2024.

This clarification was provided by Dada Olusegun, Special Assistant to President Tinubu on Social Media, in response to a report by StatiSense comparing Nigeria’s debt profile across various administrations.

EDITOR’S PICKS

- Police Arrest Man For Allegedly Killing Neighbour’s 4-Year-Old Daughter

- Misinformation Grinds Down Trust Between Govt, People -Minister

- UEFA To Honour Ronaldo For Record-Breaking Champions League Career

EKO HOT BLOG reports that Olusegun emphasized that the perceived rise in public debt is primarily due to economic factors rather than an increase in new borrowing. He assured that the Tinubu administration is dedicated to reducing the nation’s debt and is committed to transparency and responsible economic management.

Key points from Olusegun’s statement on his X account, titled “Clearing Up Nigeria’s Debt Situation Under President Bola Tinubu,” include:

Debt Tinubu Presidency Details

- Debt Reduction: Nigeria’s total debt stock decreased by 15% in dollar terms during Q1 2024, countering claims of rising debt.

- Economic Influences: The increase in public debt is attributed to several economic factors, including:

- Depreciation of the naira (from N899.39/$ to N1,330.26/$)

- Fluctuations in interest rates

- Securitization of Ways and Means

- Inherited Debt: The current administration inherited a debt of N22.7 trillion in outstanding Ways and Means, which is now undergoing audit and securitization. The current Ways and Means deficit is N3.4 trillion, counterbalanced by surpluses from revenue-generating agencies.

- External Debt: The external debt of Nigeria (Federal Government only) amounts to $42 billion, with $20.82 billion owed to multilateral creditors and $5 billion to China.

- Impact of Economic Reforms: The federal government’s economic reforms have affected foreign exchange and interest rates, contributing to the increase in public debt.

- Debt Repayment Capability: The administration maintains a solid capacity to service its debt, bolstered by improvements in the financial system.

FURTHER READING

- Israeli Forces Unleash Major West Bank Offensive

- FG Working on Steve Oronsaye Report – Gbajabiamila

- Police Arrest Man For Allegedly Killing Neighbour’s 4-Year-Old Daughter

The presidency highlighted that understanding the full scope of Nigeria’s external debt offers crucial context and underscores the factors contributing to the rise in public debt while reaffirming the government’s commitment to effective debt management and transparency.

Click here to watch our video of the week:

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611