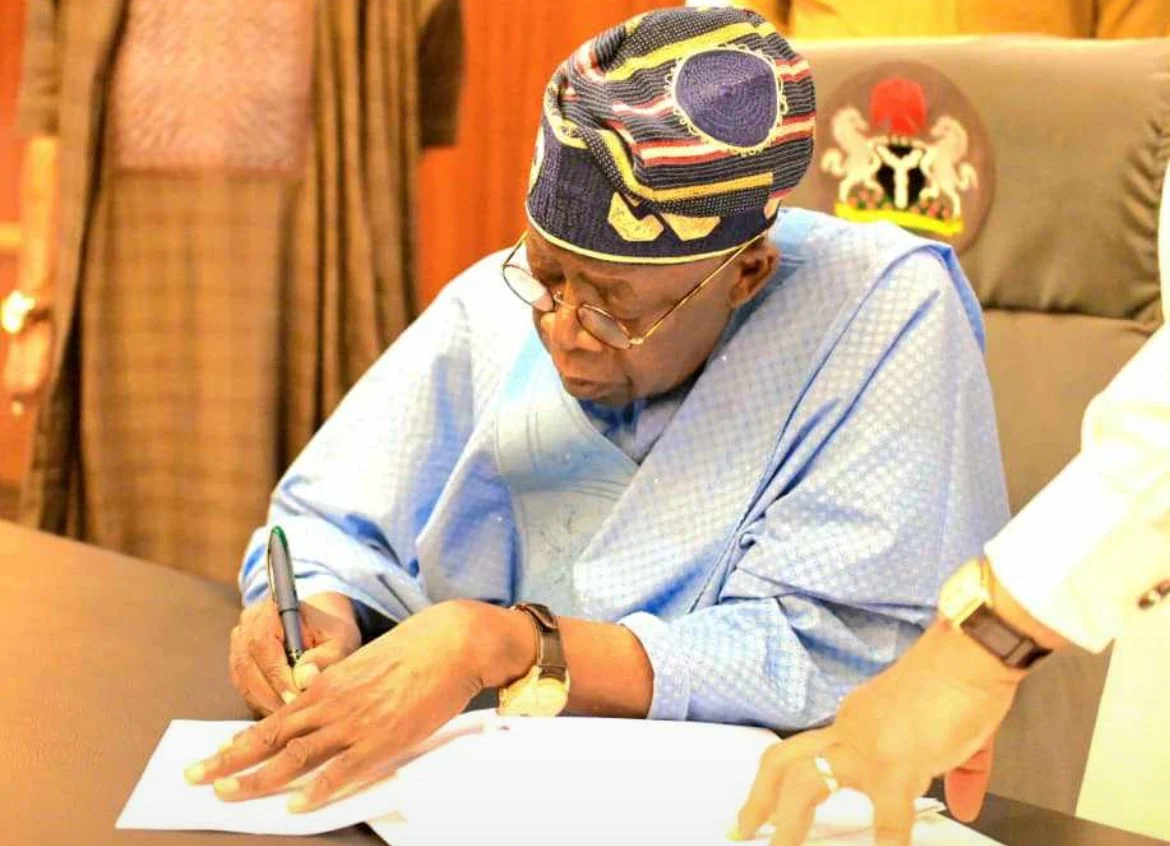

The Bola Ahmed Tinubu administration is set to withdraw the Tax Reform Bills recently presented to the National Assembly following significant backlash, especially from northern governors and traditional rulers.

The opposition is largely centered on changes to the Value Added Tax (VAT) distribution model, which many northern leaders argue would disproportionately impact their region.

According to sources gathered by Daily Trust, the presidency has agreed to retract the bills, with plans to modify and resubmit them in the near future. The National Economic Council (NEC), led by Vice President Kashim Shettima, officially recommended withdrawing the bills on October 31.

EDITOR’S PICKS

- ‘I Feel Sorry For Joshua’ After Knockout Loss To Dubois – Fury

- EPL: What We’re Lacking Is Luck – Ten Hag Reacts After Loss To West Ham

- REVEALED: Why TCN Is Struggling To Resolve Power Outages In Northern State

This recommendation aligns with a resolution from the governors of Nigeria’s 19 northern states, who met in Kaduna with prominent traditional leaders to discuss their concerns about the proposals.

Northern Governors’ Concerns

The governors’ opposition focuses on the VAT distribution amendments, which they claim would disadvantage northern states.

Gombe State Governor Inuwa Yahaya, chair of the Northern Governors’ Forum, explained that the current VAT model disproportionately benefits states where businesses are headquartered rather than those where goods and services are actually consumed, undermining economic equity across regions.

In a communiqué issued after their meeting, the northern leaders stressed that while they support beneficial reforms, any new policies must be fair and inclusive to avoid marginalizing specific regions.

NEC’s Intervention and Presidential Response

During a media briefing, Oyo State Governor Seyi Makinde stated that the NEC’s recommendation reflects an understanding of widespread concerns and the need for broader consultations.

Flanked by Governors Charles Soludo (Anambra) and Babagana Zulum (Borno), Makinde emphasized the importance of aligning all stakeholders on the tax reforms.

FURTHER READING

- Oko-Abe Community High School Nears Completion as Rep Wale Raji, Education Commissioner Tolani Alli-Balogun Inspect Epe Schools

- NLC Knocks IMF Over Fuel Subsidy Removal Denial

- N3 Billion Fraud: Labour Ministry Summons National Assembly Staff Leadership

Governor Zulum added that NEC’s decision promotes unity and clarity around the administration’s vision for tax reform, stressing the need for consensus-building.

Presidential Clarification on VAT Reforms

Earlier, Bayo Onanuga, Special Adviser to the President on Information and Strategy, addressed misunderstandings surrounding the bills.

He clarified that the VAT derivation model seeks to balance tax allocations by considering consumption locations, allowing regions that produce goods for national consumption to receive fairer compensation.

According to Onanuga, the current model prioritizes VAT based on corporate headquarters rather than where goods are consumed, and the proposed reforms would ensure equitable VAT allocation, particularly for northern regions supplying essential products.

Click here to watch our video of the week:

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611