Business

CBN Sets N1.2m Daily Transaction Limit for PoS Agents

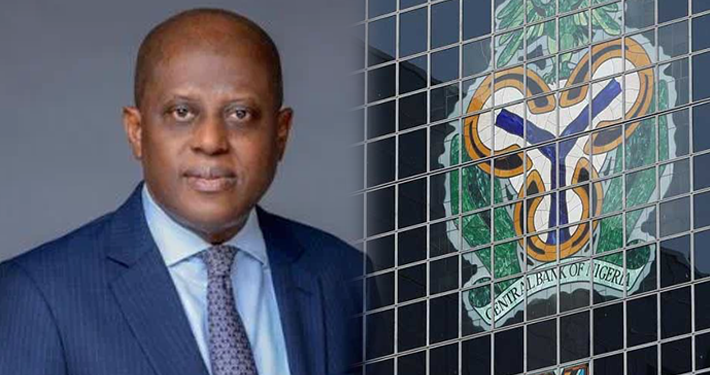

The Central Bank of Nigeria (CBN) has recently implemented a new policy limiting daily transactions for Point of Sales (PoS) agents to N1.2 million.

Eko Hot Blog reports that this decision outlined in the ‘Circular on Cash-Out Limits for Agent Banking Transactions,’ is part of the apex bank’s ongoing efforts to encourage a cashless economy in Nigeria.

EDITOR’S PICK

-

Alarming! North-West Region Top List as NBS Releases Crime Incident in Nigeria ( Check Statistics)

-

Babajide Sanwo-Olu Restates Commitment to Tackle Lagos Housing Deficit Through PPP

-

Statewide Staff Audit Reveals Ghost Worker in Jigawa State

The CBN aims to further promote digital payment methods and reduce reliance on physical cash. “The Bank hereby releases the following policy interventions, which have become necessary to enhance the use of electronic payment channels for agency banking operations,” the circular signed by Oladimeji Yisa Taiwo for the Director, Payments System Management Department, read.

According to the Nigerian Financial Services Report, agency banking, which includes Point of Sale (PoS) and mobile money services, plays a crucial role in enabling financial inclusion for individuals without traditional bank accounts.

These services facilitate transactions between people within and outside their communities, making them an essential part of the financial ecosystem.

As of July 2024, Nigeria had 3.05 million deployed PoS terminals and 4.06 million registered PoS terminals, indicating the widespread use of these services, as per data from the Nigeria Interbank Settlement System Plc.

In line with its efforts to promote a cashless economy, the Central Bank of Nigeria (CBN) has introduced new policy interventions.

One such intervention is setting a cash withdrawal limit of N500,000 per customer per week, regardless of the channel used.

Additionally, daily cash-out limits for agent banking transactions have been established, with a maximum transaction limit of N100,000 per customer and a daily cumulative cash-out limit of N1.2 million per agent.

Also, agent terminals must be connected to a Payment Terminal Service Aggregator (PTSA). “Ensure that all daily transactions per agent, including withdrawals, limits of transactions, and balances in the float accounts of each agent, are sent electronically to NIBSS as a report to the CBN. The template of this report will be sent to principals,” the apex bank noted.

According to the CBN, agent banking services are now to be demarcated from merchant activities, and agents must apply the approved Agent Code 6010 for agent banking activities.

FURTHER READING

The CBN also mandated the separation of agent banking services from merchant activities.

Consequently, agents must utilize the approved Agent Code 6010 for all agent banking activities to maintain a clear distinction between the two types of services and ensure accurate tracking of financial transactions.

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611

You must be logged in to post a comment Login