News

Banks May Block 70 Million Accounts Over NIN Linkage

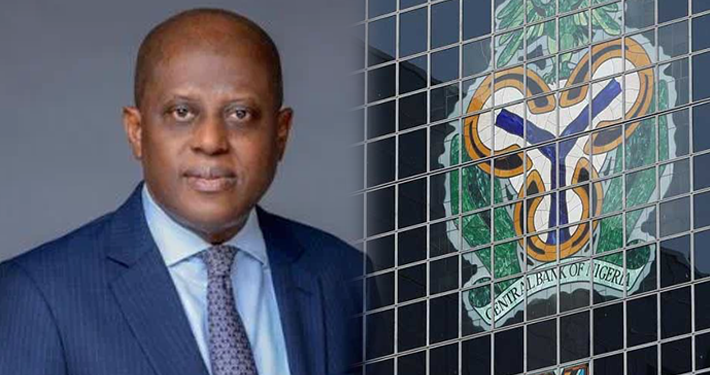

EKO HOT BLOG reports that over 70 million bank customers are at risk of losing access to their accounts as the Central Bank of Nigeria’s directive on restricting accounts without Bank Verification Numbers (BVN) and National Identification Numbers (NIN) comes into effect.

The directive, issued on December 1, 2023, mandates a ‘Post No Debit’ restriction on all accounts without BVN and NIN from March 1, 2024. This restriction freezes funds in affected accounts, rendering them inaccessible for transactions.

EDITOR’S PICKS

- A Nation at Crossroads: Balancing Health and Hardship in Nigeria’s Sachet Alcohol Ban

- Cement Hits N11,000 Per Bag In Lagos, Despite FG’s Price Slash Agreement With Manufacturers

- Reconsider Your Exit Plan, We’re Not Your Enemy, ECOWAS Tells Mali, Niger, Burkina Faso

According to the circular jointly signed by Chibuzo Efobi and Haruna Mustapha of the Payments System Management Department and Financial Policy and Regulation Department respectively, all Tier-1 bank accounts for individuals must have BVN and/or NIN. The circular also mandates the revalidation of BVN or NIN attached to all accounts by January 31, 2024.

Banks have begun notifying customers to update their accounts in line with the CBN directive. Some banks require physical branch visits, while others offer online solutions.

FirstBank Nigeria and Ecobank Nigeria have sent emails urging customers to link their BVN and NIN before February 29, 2024, to avoid restrictions. Fintech firm OPay also encourages customers to regularize accounts through online and offline options.

The directive impacts Tier-1 accounts, which are often opened with minimal documentation and targeted at the unbanked population. However, lax Know Your Customer (KYC) requirements in this space raise concerns about fraudulent activities.

NIN

Sarafadeen Fasasi, the National President of the Association of Mobile Money and Bank Agents in Nigeria, calls for an extension, citing challenges in NIN issuance and BVN enrolment capacity.

The directive comes amid the National Communications Commission’s directive to bar mobile lines without NIN, further complicating the situation for Nigerians.

Dr. Uju Ogubunka of the Bank Customers Association of Nigeria advocates for an extension, given infrastructural challenges and adverse economic conditions.

While banks have not yet restricted accounts, they’re working to create a seamless linking process. Customers continue to flock to banks to comply with the directive, urging the CBN to extend the deadline.

FURTHER READING

- Governorship Election: Why APC Will Take Over Edo – Ganduje

- Tinubu Assures ASUU Of Better Welfare

- Ondo: Aiyedatiwa Declares Gov Bid, Denies Face-off With Akeredolu

The CBN spokesperson, Hakama Sidi, did not respond to calls and text messages regarding the directive, leaving many unanswered questions about its implementation.

As the deadline approaches, Nigerians await further directives and potential extensions to mitigate the impact of the directive on banking operations and customers’ access to funds.

Click to watch our video of the week

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611