Business & Economy

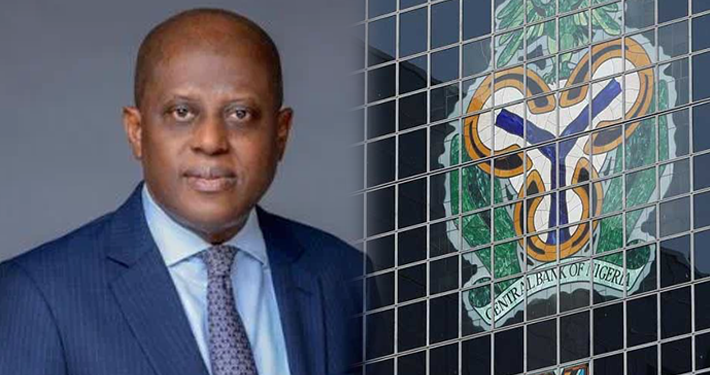

Bureau De Change Operators Kick As CBN Restricts Forex Trading

Eko Hot Blog reports that the Bureau De Change (BDC) on Saturday kicked as the Central Bank of Nigeria (CBN) announced the operational mechanism for its segment of the market to trade foreign currencies in the country.

The Apex Bank had directed all BDCs operators in the country and the general public to trade foreign currencies at similar rates obtainable on the Investor & Exporter forex window.

The new directive was contained in circular number TED/FEM/PUB/FBC/001/007 dated August 17, 2023, titled, ‘Operational mechanism for Bureau De Change operations in Nigeria’, which was made available to newsmen on Friday.

In the circular signed by the Director, Trade & Exchange Department, Dr O.S. Naji revealed that its implementation should be with immediate effect.

CBN stated that this was in support of the drive to improve the efficiency of the Nigerian foreign exchange market.

The circular stated, “The spread on buying and selling by BDC operators shall be within an allowable limit of -2.5 per cent to +2.5 per cent of the Nigerian exchange market window weighted average rate of the previous day.

“Mandatory rendition by BDC operators of the statutory periodic reports (daily, weekly, monthly, quarterly and yearly), on the financial institution forex rendition system which has been upgraded to meet operators’ requirements.

“Operators are to note that with effect from the date of this circular, non-rendition of returns would attract sanctions which may include withdrawal of operating licence.

“Where operators do not have any transactions within the period, they are expected to render nil returns. “Please, be guided accordingly and ensure compliance.”

Reacting to the development, a BDC operator who spoke to the Punch said, “We bought and sold dollars for 840/$ and 865/$ today. CBN is not giving us the dollar, and I did not get it cheap at the official rate so I cannot sell at that rate.

“How many people have access to that official rate; the dollar is still scarce and expensive.”

Another BDC who would not want to be quoted also said, “The rate we sold today is 865/$. The implication of the new guideline is that if it pays to sell at the black market, I will not sell as a licensed operator.”

Meanwhile, the President, of the Association of Bureau De Change Operators of Nigeria, Aminu Gwadabe, said the new directive was in line with the financial reform for the industry with reference to the licensed BDCs operating the guideline.

Gwadabe said, “It is an anchor rate for them if a customer comes, then you look at what is the closing rate for the I&E window and you buy at the -2.5 per cent to +2.5 per cent; the same thing if a customer comes to you, you use the same I&E window.”

He noted that the CBN, through its intelligence report, had seen that there were BDCs that, even though they were not accessing the CBN window, they were also accessing the independent window and transacting.

He added that other transactions showed that there were BDCs that were buying and selling through their accounts.

He said the CBN was also ensuring return on rendition for BDCs to report they did the transactions.

Click To Watch Our Video Of The Week

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611