Business

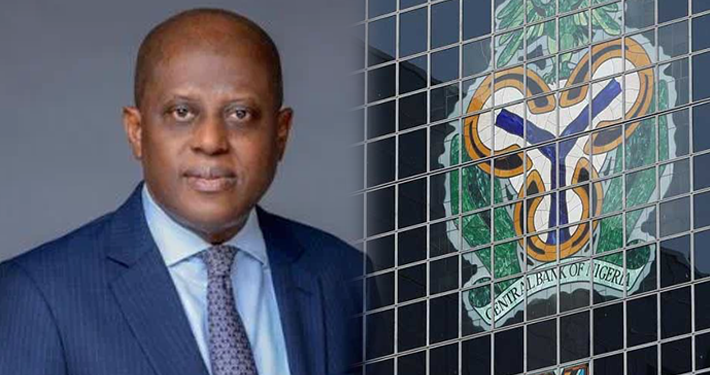

CBN Appoints New Heads for Union, Keystone, Polaris Banks

- CBN has appointed a new board of directors to govern Polaris, Union, and Keystone banks

- The former director of governors was dissolved last night

- Hadi Sirika says the appointment takes immediate effect

Eko Hot Blog reports that barely a few hours after dissolving the board of directors of governing Polaris, Union, and Keystone banks, the Central Bank of Nigeria, CBN, has appointed new executive directors to oversee the affairs of the deposit money banks.

The apex bank, in a statement signed by the acting Director of Corporate Communications, Sidi Hakama, released on Thursday morning, said the appointment takes immediate effect.

According to the statement, Yetunde Oni, the first female CEO of the Standard Chartered bank in Sierra Leone, was appointed as the Chief Executive Officer of Union Bank, while Mannir Ubali Ringim was selected as the Executive Director of the tier-2 bank.

For Keystone Bank, Hassan Imam was appointed as its Chief Executive Officer, while Chioma Mang got the position of Executive Director.

EDITOR’S PICKS

-

Unexpected Twist: NLC Halts Delegates Conference In Imo Indefinitely

-

APC Governors Meet In Abuja

-

N585m Fraud Peter Obi Reacts To Betta Edu’s Suspension

In addition, the bank appointed Lawal Mudathir Omokayode Akintola as the Chief Executive Officer of Polaris Bank and Chris Ofikulu as its Executive Director.

The CBN statement read,

“Following the dissolution of the Board and Management of Union Bank, Keystone Bank and Polaris Bank on Wednesday, January 10, the CBN has appointed new executives to oversee the affairs of the banks;

“Union Bank: Yetunde Oni – Managing Director/Chief Executive Officer Mannir Ubali Ringim – Executive Director

“Keystone Bank: Hassan Imam – Managing Director/ Chief Executive Officer Chioma A. Mang – Executive Director

“Polaris Bank: Lawal Mudathir Omokayode Akintola – Managing Director/ Chief Executive Officer Chris Onyeka Ofikulu – Executive Director

“The appointments take immediate effect,” the statement added.

Recall that on Wednesday night, the apex bank sacked the entire board of four banks for grievous infringements of financial laws, stating that the banks’ infractions vary from regulatory non-compliance, corporate governance failure, disregarding the conditions under which their licenses were granted, and involvement in activities that posed a threat to financial stability, among others.

FURTHER READING

-

Toke Makinwa’s Aunt Pleads: Give Another Man A Chance, Urges Actress To Consider Remarrying

-

DSS Busts Vandalism Ring 17 Apprehended In Niger State Operation

-

Mohbad’s Father Expresses Dissatisfaction With Police Probe

Hence, the apex bank, in the exercise of its regulatory powers, disclosed that the dissolution of the boards became necessary due to the non-compliance of the banks and their respective boards with the provisions of the Financial Institutions Act, 2020.

This action followed the recommendation of the Special Investigator, Jim Obazee, appointed by President Bola Tinubu in July 2023, to probe the activities of the CBN and other relevant establishments.

The report of the special investigation into the activities of the CBN had accused the immediate past Governor of the apex bank, Godwin Emefiele, of acquiring banks for himself through proxies, as it further revealed that Emefiele used proxies to acquire Union Bank of Nigeria for Titan Trust Bank Limited and Keystone Bank without any evidence of payment.

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611