Business

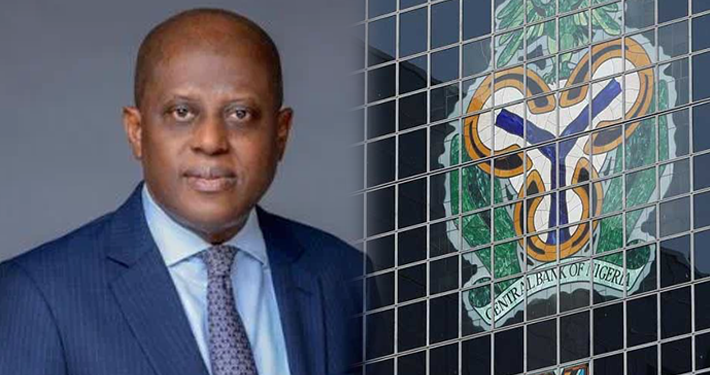

CBN Hikes Banks’ Cash Reserves Ratio To 27.5 Percent

Nigeria’s apex bank, Central Bank of Nigeria, CBN, has increased the Cash Reserves Ratio, CRR, of banks from 22.5 per cent to 27.5 per cent.

The alteration was done by the Monetary Policy Committee of the CBN.

The Cash Reserve Ratio is the share of a bank’s total deposit that is mandated by the CBN to be maintained with the latter in the form of liquid cash.

The CRR is used by the CBN to ensure that a part of Deposit Money Bank’s cash is with the Central Bank and is hence, secure.

Godwin Emefiele, Central Bank of Nigeria, CBN’s Governor, while addressing journalists shortly after the committee’s meeting said the move was aimed at mopping up excess liquidity from the banking system which had become a threat to inflation.

According to him, nine members of the committee voted to alter the CRR from 22.5 per cent to 27.5 per cent.

He explained that apart from the CRR that was increased, the committee decided to retain the Monetary Policy Rate at 13.5 per cent.

Also retained are the Liquidity Ratio which was left at 30 per cent; and the Asymmetric Window which was left at +200 and -500 basis points around the MPR.- PMNews

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611