Eko Hot Blog reports that the anti-graft agency, Economic and Financial Crimes Commission, has broadened its investigation into forex allocations, now encompassing scrutiny of certain foreign firms that operate within Nigeria.

Recent discoveries revealed that the Economic and Financial Crimes Commission (EFCC) is currently investigating the allocation of a minimum of $347 billion to companies in Nigeria between January 2014 and June 2023.

Editor’s Picks

-

Tinubu Set To Sack Underperforming Ministers

-

Ganduje Makes First Visit To Kano, Woos Gov. Yusuf To APC

-

Police Turn Down N1 Million Bribe, Arrest Bandit In Kaduna Hotel

Nevertheless, an analysis of Central Bank of Nigeria data conducted on Wednesday revealed that both local and foreign companies in Nigeria received a minimum of $347.49 billion from Apex Bank to fulfil their foreign exchange requirements and obligations within the 10-year period.

This data, found in the sectoral utilization of the CBN’s forex data, provides insights into how foreign exchange is allocated and utilized across various sectors or industries of the economy.

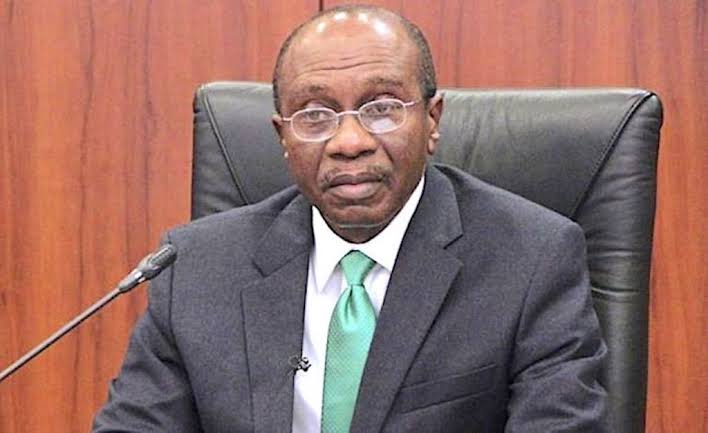

This development unfolds in the context of the EFCC’s investigation into forex allocations to Dangote Group and 51 other companies during the tenure of the immediate past Governor of the Central Bank of Nigeria, Godwin Emefiele.

This news medium gathered that the EFCC focused on these 52 companies as they received the largest share of the $347 billion within the specified timeframe.

As of the time of this report on Thursday, the exact amount received by the 52 top recipients of forex allocation under Emefiele during the reviewed period remains undisclosed.

In the import category, an examination of the Central Bank of Nigeria’s quarterly statistical bulletin revealed that sectors such as industrial, food products, manufactured products, transport, agriculture, minerals, and oil were among those benefiting from forex allocation.

Furthermore, various sectors benefiting from forex allocation include communication, construction and related engineering, distribution, education, environment, financial, health and social services, tourism and travel, recreational, cultural, and sporting services.

Breaking down the allocation per year, the Central Bank of Nigeria disbursed $65.99 billion in 2014, $44.6 billion in 2015, $25.5 billion in 2016, $27.64 billion in 2017, $40.81 billion in 2018, $43.99 billion in 2019, $28.24 billion in 2020, and $16.4 billion between January 2021 and September 2021.

Additionally, a disbursement of $17.38 billion occurred between October 2021 and March 2022, followed by a sum of $36.88 billion provided between April 2022 and June 2023.

Further Reading

-

Lagos Govt Set To Commence Construction Of Fourth Mainland Bridge

-

Police Turn Down N1 Million Bribe, Arrest Bandit In Kaduna Hotel

-

Mr Ibu’s Son, Daughter Arrested For Allegedly Misappropriating N55 Million Donation

According to reports, 52 companies have received directives to furnish documents substantiating the allocation and utilization of foreign exchange provided to them at official rates over the last decade.

The EFCC has specifically requested these firms to submit their Form A and Form M, detailing their forex allocations from 2014 to June 2023.

Click To Watch Our Video Of The Week

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611