Business & Economy

Naira In Circulation Drops By N37.84 Billion In February 2022 – CBN

-

The Central bank of Nigeria has disclosed that the Naira In Circulation Drops By N37.84 Billion In February 2022

- CBN in her communique of the recent 284th MPC meeting disclosed that they disbursed a sum of N29.67 billion between January and February 2022 under the Anchor Borrowers’ Programme (ABP) for the procurement of inputs and cultivation of maize, rice, and wheat

EDITOR’S PICK:

- MTN Nigeria Plc Loses Over N20 Billion Within 24hrs

- NNPC Secures $5bn Funding From Afreximbank For Nigeria’s Oil Industry

- How Covenant University Graduate, Tobi Ifabiyi, Squandered N80million Investors’ Money

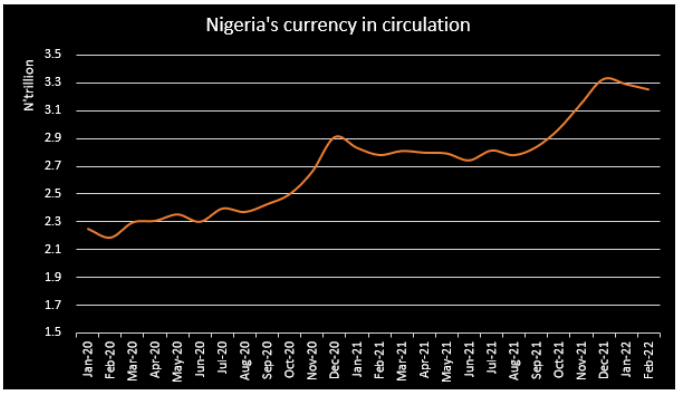

EKO HOT BLOG reports that the Naira in circulation in Nigeria fell by N37.94 billion in February to N3.25 trillion compared to N3.29 trillion recorded as of January 2022.

This represents a 1.2% decline on a month-on-month basis, while when compared to the corresponding period of 2021, it increased by 16.95% compared to N2.78 trillion as of February 2021.

This is according to data from the money and credit report of the Central Bank of Nigeria (CBN).

The Naira in circulation has recorded significant growth since the Central Bank maintained its dovish monetary approach as a means to ensure the recovery of the nation’s economy, following the recession recorded in 2020, caused by the covid-19 pandemic.

The several intervention policies pushed the Naira in circulation to its highest level in history in December 2021. However, it has recorded a decline in two consecutive months, dropping by N37.13 billion in January and N37.84 billion in February 2022, Nairametrics reports.

Private sector credit increased by N1.46 trillion

Credit by banks to the private sector increased by N1.46 trillion in February to N36.91 trillion from N35.45 trillion recorded as of the previous month. This represents an increase of 4.1% month-on-month.

- This is significantly higher than the additional gain of N257.45 billion recorded in the previous month, largely due to the borrowing policy to stimulate economic growth by the CBN.

- Meanwhile, currency outside the banks as of February 2022 was N2.73 trillion, which is 1.7% lower than the N2.78 trillion as of the previous month, representing a decline of N47.53 billion.

- Banks’ credit to the government also increased by 4.5% in February 2022, improving from N14.28 trillion recorded as of January 2022 to N14.92 trillion.

- The growth in credit to both private and government parastatal could be attributed to the Central Bank’s policies to stimulate the economy. Also, innovation in technology and the surge in the number of FinTechs in the lending space has brought more competition to the lending space.

This online media platform recalls that the CBN in her communique of the recent 284th MPC meeting disclosed that they disbursed a sum of N29.67 billion between January and February 2022 under the Anchor Borrowers’ Programme (ABP) for the procurement of inputs and cultivation of maize, rice, and wheat.

- These disbursements bring the total under the programme to over 4.52 million smallholder farmers, cultivating 21 commodities across the country, coming to a total of N975.61 billion.

- Also, the apex bank released N19.15 billion to finance 5 large-scale agricultural projects under the Commercial Agriculture Credit Scheme (CACS), bringing the total disbursements under the Scheme to N735.17 billion for 671 projects in agro-production and agro-processing.

- In addition to these, the Bank disbursed the sum of N428.31 billion under the N1 trillion Real Sector Facility to 37 additional projects in the manufacturing, agriculture, and services sectors.

- Additionally, under the 100 for 100 Policy on Production and Productivity (PPP), the Bank has disbursed the sum of N29.51 billion to 31 projects, comprising 16 in manufacturing, 13 in agriculture, and 2 in healthcare.

FURTHER READING:

- Top 5 Video Marketing Tips For Small Businesses

- FULL LIST: CBN Removes ATM Maintenance Fee, Cuts Other Bank Charges

- How To Apply For CBN Agric Small and Medium Enterprise Scheme (AGSMEIS) Loan

The Monetary Policy Committee (MPC) of the Central Bank voted to hold the MPR at 11.5%, keeping other parameters constant as six of the members voted to hold, three members voted to raise MPR by 25-basis points, while only one member voted 50-basis points raise.

Click to watch our video of the week:

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611