News

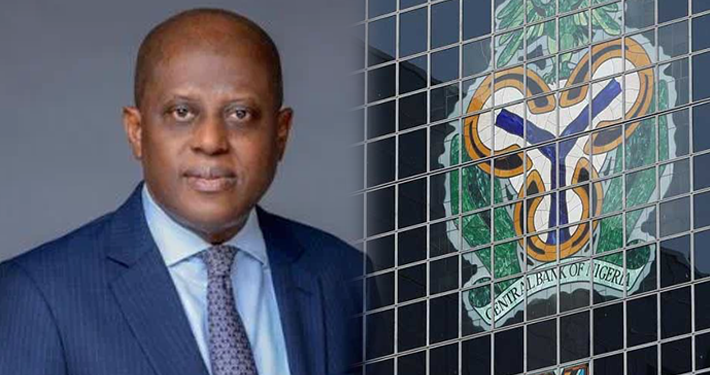

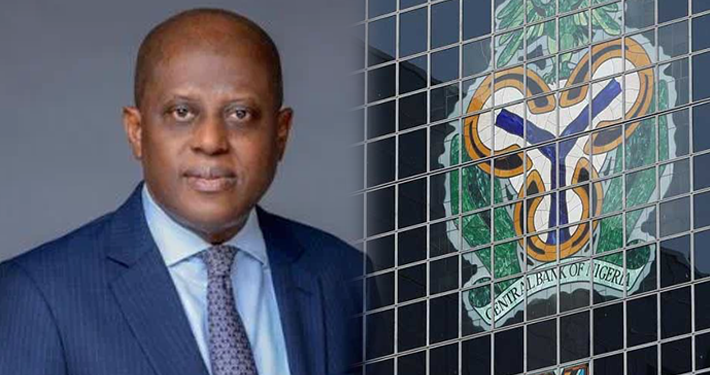

CBN Grants Six-Month Extension For BDC Operators’ Recapitalisation

The Association of Bureaux De Change of Nigeria (ABCON) has announced that the Central Bank of Nigeria (CBN) has extended the deadline for Bureaux De Change (BDC) operators to complete their recapitalisation by six months, moving the new deadline to June 3, 2025.

ABCON President, Aminu Gwadabe, disclosed this development during a virtual general meeting held with members on Monday. He revealed that the extension follows the introduction of new operational guidelines by the CBN in May, which came into effect on June 3, 2024.

EDITOR’S PICKS

- Japa: Russia Opens Doors to Migrants Amid Workforce Shortage

- Crisis Erupts at Celestial Church of Christ in Lagos Over N5m Donation

- EFCC Alleges Nigerian Banks Are Channels for Money Laundering

EKO HOT BLOG reports that the guidelines require existing BDCs to reapply for new licences under two categories—Tier 1 and Tier 2—with minimum capital requirements of ₦2 billion and ₦500 million, respectively. Tier 1 and Tier 2 BDCs are also mandated to pay non-refundable licence fees of ₦5 million and ₦2 million.

Gwadabe expressed appreciation to the CBN for the deadline extension, stating, “The CBN is willing to partner with BDCs to ensure the recapitalisation process is seamless. We thank the CBN for listening and giving us a six-month extension.”

The president encouraged BDC operators to embrace the recapitalisation process as an opportunity for growth, emphasizing that the changes offer significant benefits. He noted that while the deadline applies to existing BDCs, new operators seeking licences have no fixed timeline.

Under the CBN’s guidelines, BDCs are authorized to source and sell foreign exchange, open foreign currency and naira accounts with commercial or non-interest banks, and collaborate with banking partners to issue prepaid debit cards.

CBN BDC Operators’ Recapitalisation

Over 220 CBN-licensed BDC operators, members of the ABCON Council, and key stakeholders attended the meeting, which highlighted the steps being taken by operators to meet the new capital requirements.

The extended timeline aims to ensure a smooth transition for BDCs while fostering collaboration between the CBN and operators in the sector.

FURTHER READING

- Week 21 Pool Results For Saturday, Nov 23, 2024: Latest Updates

- Why I Didn’t Present my Certificate of Return to APC Chairman Ganduje – Aiyedatiwa

- Guardiola Pledges To Stay With Manchester City Even If Relegated

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611

You must be logged in to post a comment Login