News

‘Publish What You Met In Treasury’ – Ondo Senator Tells Tinubu

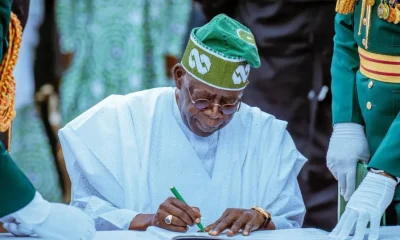

EKO HOT BLOG reports that Ondo South Senator, Dr Jimoh Ibrahim, has urged President Bola Ahmed Tinubu to publish what he met in the treasury when he assumed office on May 29.

In a statement on Monday, the lawmaker and businessman urged the President to disclose some information from the handover notes he received from former President Muhammadu Buhari.

Ibrahim called on the President to reveal what the Gross Domestic Product (GDP) to debt ratio was, what was GDP-to-cash flow ratio, and other indices when he assumed office.

EDITOR’S PICKS

-

PDP BoT Demands Resignation Of Anyanwu As National Secretary

-

INEC Makes U-Turn On Manually Results Transmission Of Bayelsa, Imo, Kogi States Elections

-

Lagos: Jandor Files 34 Grounds Of Appeal Against Tribunal On Sanwo-Olu’s Election Victory Verdict

The lawmaker asserted that no matter the good intention of the president’s policy, lack of communication will be a big challenge.

He said, “The policies of this government have good intentions, but of course, you know the short-term effects they are having on the economy, which is why the information minister needs to get those facts across to Nigerians.

“Legitimacy is key, and Asiwaju means well, but he needs to put out some information. After all, he got handover notes from former President Buhari, so why won’t he publish them and tell Nigerians what he met on the ground?

“For instance, what was the GDP to debt ratio, what was the GDP to cash flow ratio, and other indices so that Nigerians will know? Then he explains that he is taking or not taking some policies now because this will be the impact it will have on the economy considering what is on the ground. To me, that is how it should be. If not, Nigerians will always perceive it differently.”

Speaking further, Ibrahim noted that the issue of borrowing is not the problem in Nigeria but borrowing to invest in critical sectors of the economy.

He said: “Our debt service to GDP is 30 per cent, and our cash flow to GDP is 1.3 per cent of GDP which is the worst in the world, which means that the cash available for Tinubu to spend is 1.3 per cent of the GDP, and we have capital projects. He had to appoint ministers and also run the government. So what will be left for the country to move?

“The option we have is to tax more people to create revenue because tax to GDP is 18 per cent, but the country doesn’t have a very large buoyant population. The other option is through ways and means to print more money, but by doing that, you weaken the naira, so the next option is to borrow.

FURTHER READING

-

Ondo Assembly Deny Suspending Impeachment Process Against Aiyedatiwa

-

Oil Marketers Set To End NNPCL’s Fuel Monopoly, Resume Importation Of Petrol

-

Tinubu, Sultan, Ado Bayero, Others Listed Among 500 World Influential Muslims

“However, borrowing is not bad, but we need to borrow and invest in infrastructure because even the IMF had said that the debt rate to global GDP is 135 per cent, which means that the world has over-borrowed, and it is not only peculiar to Nigeria. As such, we need to borrow and invest in critical infrastructure.”

Click to watch our video of the week

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611