News

Explained: 10 Ways Tinubu’s Tax Reform Bills Will Benefit States

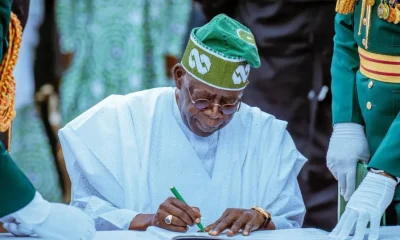

President Bola Tinubu’s Senior Special Assistant on Media and Publicity, Temitope Ajayi, has outlined how the controversial Tax Reform Bills are designed to enhance states’ revenue generation and economic growth.

The bills – the Nigeria Tax Bill 2024, Nigeria Tax Administration Bill, Nigeria Revenue Service (Establishment) Bill, and Joint Revenue Board (Establishment) Bill – have faced backlash from state governors and stakeholders.

EDITOR’S PICKS

- Japa: Russia Opens Doors to Migrants Amid Workforce Shortage

- Crisis Erupts at Celestial Church of Christ in Lagos Over N5m Donation

- EFCC Alleges Nigerian Banks Are Channels for Money Laundering

EKO HOT BLOG reports that however, Ajayi emphasized that these reforms will address fiscal inefficiencies and promote shared prosperity.

On Tuesday, Tinubu directed the Ministry of Justice to collaborate with the National Assembly to address public concerns and ensure the passage of the bills. During a Channels Television Townhall on Tax Reforms, the Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, clarified that the reforms aim to fix Nigeria’s underperforming economy rather than merely increase revenue.

“Our economy is underperforming with widespread poverty and unsustainable growth. The fiscal and tax system is like a knee on the neck of our economic prosperity. These reforms are not primarily about generating revenue but about fixing the economy for shared prosperity,” Oyedele said.

Despite this assurance, some leaders, including Borno State Governor Babagana Zulum, have opposed the bills. Zulum argued they would harm Northern economies and called on Tinubu to withdraw them.

Tinubu’s Tax Reform Bills

Ajayi countered these concerns by highlighting 10 ways the Tax Reform Bills will benefit states:

- Increased VAT Revenue: The Federal Government will cede 5% of its current 15% share of Value-Added Tax (VAT) revenue to states.

- Electronic Money Transfer Levy: Income from this levy will be transferred exclusively to states as part of stamp duties.

- Modernized Stamp Duty Laws: Obsolete stamp duty laws will be repealed, enhancing state revenues through simplified legislation.

- Tax on Limited Liability Partnerships: States will gain the authority to tax Limited Liability Partnerships, increasing their revenue streams.

- Tax Exemption on State Bonds: State governments will enjoy tax exemptions on their bonds, aligning them with federal government bonds.

- Equitable VAT Distribution: A new model for VAT attribution and distribution will increase states’ income.

- Integrated Tax Administration: This will provide tax intelligence, strengthen states’ capacity, and enhance collaboration through the Tax Appeal Tribunal.

- Recovery of Unremitted Taxes: The Accountant-General of the Federation will be empowered to deduct unremitted taxes from federal agencies and remit them to state governments.

- Autonomy for State Revenue Services: A framework will grant autonomy to state internal revenue services and enhance collaboration through the Joint Revenue Board.

- Tax on Lotteries and Gaming: New laws will introduce withholding taxes on lotteries and gaming for states’ benefit.

Ajayi dismissed concerns that the bills are injurious to states, stating they streamline taxation and incentivize economic growth. He urged governors to invest in infrastructure and manpower to maximize the reforms’ potential.

While debates continue, the government insists that the reforms are a step toward a stronger and more equitable economy.

FURTHER READING

- Week 21 Pool Results For Saturday, Nov 23, 2024: Latest Updates

- Why I Didn’t Present my Certificate of Return to APC Chairman Ganduje – Aiyedatiwa

- Guardiola Pledges To Stay With Manchester City Even If Relegated

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at [email protected]. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611