News

‘We Will Not Extend Naira Notes Deadline’ — CBN

-

The CBN has insisted that the 31st January deadline to halt the use of the old 200, 500 and 1000 naira notes still stands.

-

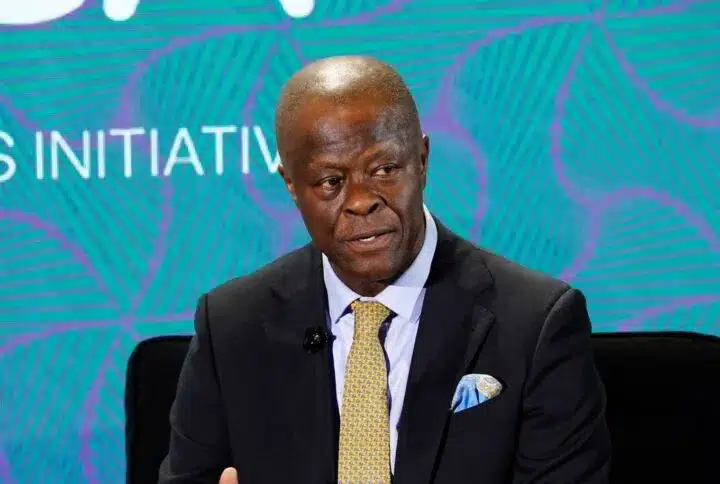

Emefiele said this during the CBN/Monetary Policy Committee (MPC) briefing in Abuja.

-

Also at the meeting, the CBN raised the Monetary Policy Rate (MPR), which measures interest rate, to 17.5 per cent.

EKO HOT BLOG reports that the Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, on Tuesday said the apex bank will not extend the deadline to halt the use of the old 200, 500 and 1000 Naira notes.

Emefiele said this during the CBN/Monetary Policy Committee (MPC) briefing in Abuja.

EDITOR’S PICKS

-

2023: Wike Drops Fresh Hint On Preferred Presidential Candidate

-

BREAKING: DSS Arrests Peter Obi’s Ex-DG, Doyin Okupe At Lagos Airport

-

Panic As Gunmen Attack Train Station, Abduct Scores Of Passengers

“I don’t have good news for those who feel we should shift the deadline; my apologies,” Emefiele said.

“The reason is because 90 days should be enough for those who have the old currency to deposit it in the banks.”

This newspaper reports that the deadline for the termination of the old Naira notes as legal tender is January 31st, 2023.

Also at the meeting, the CBN raised the Monetary Policy Rate (MPR), which measures interest rate, to 17.5 per cent.

FURTHER READING

-

BREAKING: S’Court Declares Akpabio Authentic APC Senatorial Candidate In A’Ibom

-

JUST IN: ‘Reverse Unlawful Electricity Tariff Hike Now’ — SERAP Tells Buhari

-

JUST IN: Army Debunks Reports On Release Of Abducted Female Soldier

The MPC raised the monetary policy rate by 100 basis points to 17.5% and kept the asymmetric corridor at +100/-700 basis points around the MPR

Click here to watch our video of the week:

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at ekohotblog@gmail.com. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611