News

Yuletide: Cash Scarcity Persists Despite CBN’s Directives To Banks

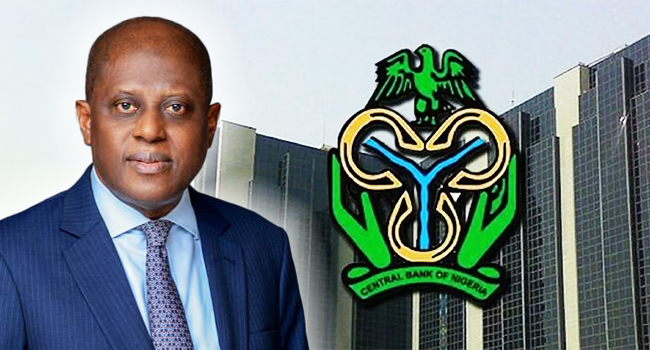

Despite recent directives from the Central Bank of Nigeria (CBN) to curb artificial cash scarcity, findings indicate that the situation remains dire in parts of the country.

A November 29 circular, signed by Acting Directors Solaja Olayemi and Isa-Olatinwo Aisha, directed Deposit Money Banks to ensure efficient cash disbursement via ATMs and over-the-counter channels, warning of sanctions for non-compliance.

EDITOR’S PICKS

- PDP Declares Ethiope East Federal Seat Vacant Following Ibori-Suenu’s Defection to APC

- Retired Principals Call for Recognition and Better Welfare from Government

- BREAKING: IGP Egbetokun Orders Major Shake-Up, Deploys New AIG to Lagos FCID Annex

EKO HOT BLOG reports that the apex bank also released contact information for customers to report cash access challenges.

However, reports reveal continued scarcity. In Abuja, banks limit over-the-counter withdrawals to as little as ₦5,000 in some cases. ATMs dispense slightly higher amounts, with one United Bank for Africa branch capping withdrawals at ₦20,000. Similar constraints were observed in Lagos, Delta, Ondo, and Imo states.

Residents in Akure and Ilorin lamented the challenges, with PoS operators struggling to access sufficient cash from banks. In Abia, ATM withdrawals ranged between ₦5,000 and ₦10,000, while over-the-counter limits varied across states, reaching ₦50,000 in some locations.

Sources within the banking sector attributed the scarcity to inadequate cash allocation by the CBN, exacerbated by lingering effects of the naira redesign policy under former Governor Godwin Emefiele. The policy reportedly destroyed old notes without providing sufficient replacements, while skepticism among depositors worsened the situation.

The National President of the Association of Mobile Money and Bank Agents in Nigeria, Fasasi Atanda, accused businesses like petrol stations and supermarkets of hoarding cash and selling it at inflated rates to dealers, further straining availability.

Cash Scarcity CBN Directives

Atanda proposed that the CBN engage PoS operators as official cash distribution agents to alleviate the crisis. Meanwhile, critics accused banks of prioritizing bulk withdrawals for wealthy customers, leaving ordinary Nigerians in distress.

CBN spokesperson Mrs. Hakama Sidi Ali did not respond to inquiries as of press time.

FURTHER READING

- Ensure Available Of Naira Notes Nationwide -Shettima Tasks Banks

- Alleged Mass Killings: NHRC Seeks Justice For Victims

- Federal Government Allocates N700bn for Free Meter Distribution

Here’s the video of the week:

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at ekohotblog@gmail.com. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611