Featured

Opinion!!! Bobrisky and Tax Reforms in Nigeria

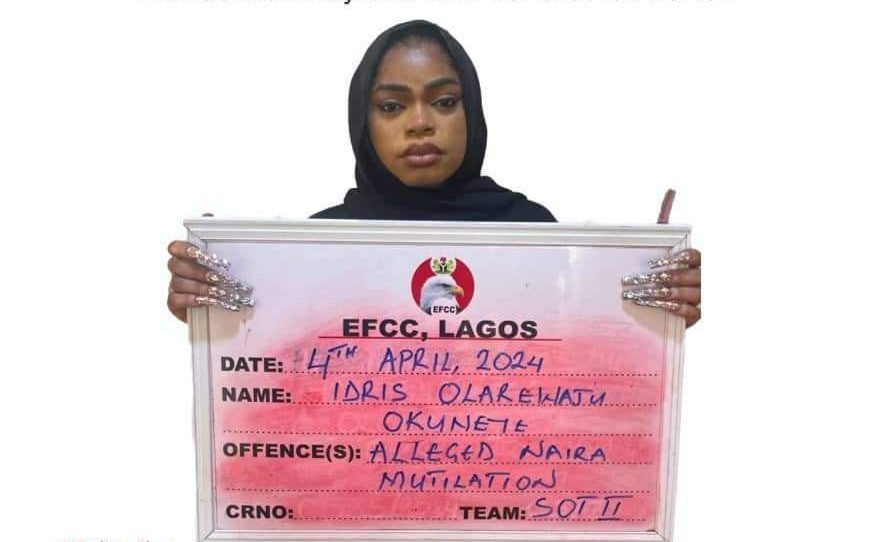

The charade of Nigeria is never-ending! Only recently, one of Nigeria’s best-known cross-dressers, Idris Okuneye, alias Bobrisky, was arrested on charges of abusing banknotes.

He was later convicted and sentenced to six months in prison.

Not long after, popular socialite, Pascal Okechukwu, aka Cubana Chief Priest, was also arrested for alleged naira abuse and he’s already being prosecuted. Nigerians wait to see how events unfold!

EDITOR’S PICKS

In the considered opinion of this writer, jailing Bobrisky is, to say the least, amusing! It’s too pedestrian! As things stand, Nigeria’s revenue target reportedly stands at N18 trillion.

Of course, that’s pathetic! Where things work, the target should be nothing less than N50 trillion. So, the country needs revenue, certainly not by Nollywood sideshows but by passing an Unexplained Source of Income Act.

For God’s sake, why pick Bobrisky and what does the Economic and Financial Crimes Commission ((EFCC) want from him? Well, if the arrest was to teach the self-styled cross-dresser some lessons of life, then, that’s a different story. Otherwise, it was a mere distraction and whoever mooted the ideas in the first place did not deserve our claps.

If we are talking about the debasement of the naira and what ought not, what the EFCC needs is not whether people spray money or not. Yes, Bobrisky was spraying naira! But what happens next?

File Image of EFCC Headquarters

In other climes, Bobrisky would never be banned for disdainfully soothing his ego. In countries like the United Kingdom and Sweden for example, if one goes to an ‘Owambe’ party and spices it up recklessly with pounds or euros, that’s one’s business!

If one even likes, one can invite King Sunny Ade and ‘Professor Master General’ Kollington Ayinla to England to treat one’s audience to the melodious tunes of ‘Ijo Yoyo’. Nobody cares! But the consequence is that a tax bill awaits one immediately the party is over! In other words, what the government does is to invoke the Unexplained Wealth Orders (UWOs) 2017.

By implication, the Nigerian government doesn’t need to pass a law restraining the people from ‘spraying’ naira notes. It only needs to ask some pertinent questions relating to the defaulter’s sources of wealth vis-à-vis his or her tax returns.

Unfortunately, Nigeria’s government agencies are either too lazy or are not sincerely interested in generating revenue for the government.

If we are serious about fighting corruption in Nigeria, what we need is not some showboating. Nigeria doesn’t have to reinvent the wheel! So, instead of running round and round in circles, wasting so much time doing nothing, what’s needed is a surgical operation on the economy.

The real issue is that Nigerians are not paying taxes and that’s why they are always ‘spraying’ money rashly. If we have the Unexplained Source of Income Act in Nigeria, which we ought to have had about 30 or 40 years ago, no Bob would have attempted to risk his waist on our naira notes because he perfectly understood the consequences.

This brings us to another sideshow a la Yahaya Bello! The fact that the immediate past governor of Kogi State is evading arrest from lawful authorities is symptomatic of a country without functional laws; and that’s unacceptable!

It is because it has happened and nothing ever happened thereafter that it is now happening, because nothing will eventually happen! After all, once upon a time in Nigeria’s chequered history, one Nyesom Wike shielded one Rotimi Amaechi from lawful arrest and nothing happened!

So, what’s the big deal? Could we have contemplated the former Governor of Wisconsin in the USA evading arrest? Even former President Donald Trump submitted himself to investigation and he’s currently having his day in court.

So, who is Yahaya Bello and what’s special about the ‘ta-ta-ta-ta’ inventor? Shouldn’t Nigeria, at least, for once, be spared of pantomimes fooling around?

Remember Alphonse Gabriel Capone, aka Scarface, the American gangster, businessman and boss of the ‘Chicago Outfit’! Remember also Eliot Ness, the brilliant, incorruptible American Prohibition agent and leader of ‘The Untouchables’!

In his time, Capone killed a lot of people, including the Saint Valentine’s Day Massacre, but he didn’t leave any trace that could lead to his arrest for murder. He was also making millions of dollars without declaring tax returns. On Ness’s advice, Capone’s accountant was dragged into the case. On October 18, 1931, Capone was convicted after trial and jailed for income tax evasion, not murder, on November 24, 1931.

The heart of the matter is that these are tax issues! So, the Federal Inland Revenue Service (FIRS) should have asked Bello the sources of his wealth vis-à-vis his tax returns.

Pure and simple! In sane climes, the EFCC itself should be nothing more than a desk in the police force, just like the Fraud Office in England; and Nigeria would have been spared the rigour of the creation and duplication of the functions in the Ministries, Departments and Agencies.

As a matter of fact, the Fraud Office operatives are more technically competent than the EFCC can ever be!

At a time like this, it’s better Nigeria faces the real issue; and the real issue is that super-rich Nigerians have not been paying taxes.

Let’s face it, the day Nigeria gets serious, she will catch up with the developed nations within 15 years. For instance, the EFCC is accusing Bobrisky and Cubana of naira debasement, there are lots of wedding activities across the country, even as we speak.

Has the EFCC prepared its operatives for the onerous task of even arresting prospective naira abusers? Has the Commission ever asked how some Nigerians get brand new, untouched notes while those who run legitimate accounts are starved of even the old ones? If one may also ask, how do our Point of Sale (PoS) system operators source the wares for their ventures?

President Bola Tinubu is the head of the government. Again, this where he has to act before things get out of hand! If he truly wants to reform the country, this is the time to do so. But if he wants business to continue as usual, then good luck to him and good luck to Nigeria! So far, so good, a lot of his policies are right and are on the right path!

Definitely, the criminal subsidy removal is painful; he should have thought about it better and come up with better ideas about how to mitigate its effects! The merging of the foreign exchange rates was also traumatizing.

But it should be applauded! At least, the naira is now coming down and the speculators now know how far they can go! Going forward, let Tinubu go the whole hog! From the look of things, Nigeria is a one-party state, as most of the National Assembly members are from the ruling All Progressives Congress (APC), which makes his job easier.

Therefore, let the president lobby the National Assembly to enact the Unexplained Source of Income Bill, modeled on the UWOs which was introduced into the United Kingdom legislation under the 201 Criminal Finances Act.

Except we want to be economical with the truth, tax evasion is feasible when the system allows for it! All the more reason Tinubu should empower the FIRS by making it the pivotal figure in revenue generation.

FURTHER READING

-

Maternity Health: Pate, Alausa Launch Labour Guide, Guidelines For Misoprostol, Calibrated Drape Use

Those who earn more should pay more and the charade of over-taxing the poor to pay the rich should come to an end.

With the passage of the Unexplained Source of Income Act, the government will generate more revenue, especially from those who are currently evading taxes. It is really annoying that Nigeria keeps taxing the poor while ‘blessing’ the rich with tax holidays.

May the Lamb of God, who takes away the sin of the world, grant us peace in Nigeria!

_●ijebujesa@yahoo.co.uk;_

_●08098614418 – SMS only._

Click here to watch our video of the week:

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at ekohotblog@gmail.com. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611