Lagos State Governor Babajide Sanwo-Olu has refuted allegations that Lagos will gain disproportionately from the proposed tax reforms, urging Nigerians to thoroughly study the provisions before...

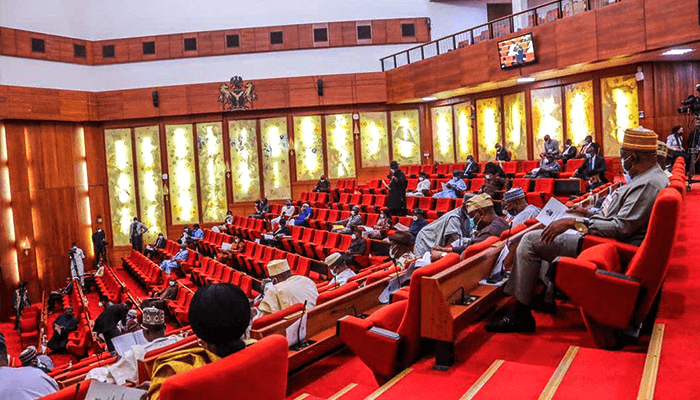

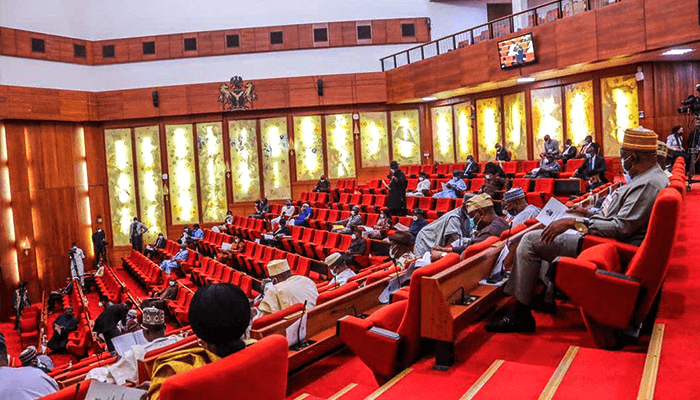

The Senate has temporarily halted discussions on the controversial Tax Reform Bills, directing its Committee on Finance to pause public hearings pending resolutions to public concerns....

Taiwo Oyedele, Chairman of the Presidential Committee on Tax Policy and Fiscal Reforms, has firmly rejected any plans to engage Alpha-Beta Consulting or other external consultants...

Taiwo Oyedele, chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has explained the reasoning behind the proposal to rename the Federal Inland Revenue...

Deputy spokesman of the House of Representatives, Mr. Philip Agbese, has alleged that some governors are coercing federal lawmakers to withdraw their support for President Bola...

Zacch Adedeji, the Executive Chairman of the Federal Inland Revenue Service (FIRS), has refuted claims that the federal government intends to impose new taxes or increase...

The federal government is planning to raise the Value Added Tax (VAT) from 7.5 percent to 10 percent. EKO HOT BLOG reports that an executive bill...

No Proposed Increase in VAT Rate Input VAT Credit for Businesses Suggested Basic Goods and Services to be VAT-Exempt Eko Hot Blog reports that, addressing concerns...

Federal Government denies proposing VAT rate increase Chairman of Presidential Committee, refutes earlier media reports, stating proposals were misrepresented. Committee proposes a VAT credit for businesses,...

Eko Hot Blog reports that Lagos State Governor, Babajide Sanwo-Olu, has called on the Presidential Committee on Fiscal Policy and Tax Reforms to identify and eliminate...