Business & Economy

Telecos to Cut Bank USSD Access Today Over Unpaid Debt

- The Nigerian Communications Commission (NCC) had previously issued a directive on January 15, 2025, ordering nine banks to clear their debts by January 27, 2025, or risk losing access to their USSD codes

- He urged the remaining non-compliant banks to fulfill their financial obligations by the close of business today to avoid potential disruptions to the USSD service

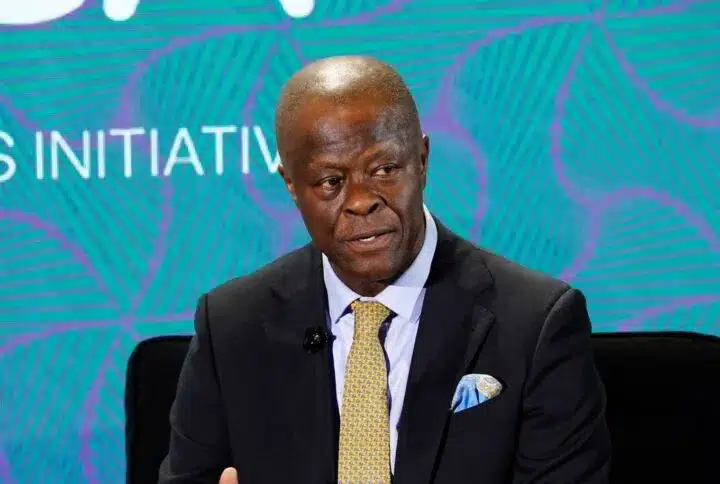

Gbenga Adebayo, Chairman of the Association of Licensed Telecommunications Operators of Nigeria (ALTON), has expressed concern over the outstanding debts owed by certain banks to mobile network operators, including MTN and Airtel.

Eko Hot Blog gathered that the issue centers around the Unstructured Supplementary Service Data (USSD) service, which enables millions of Nigerians to conduct banking transactions without internet access.

EDITOR’S PICK

- Speed Darlington Claims Assassination Attempt After Release from Kuje Prison

- Former Super Eagles Goalkeeper, Moses Effiong Dies at 65

- FG begins recruitment into federal civil service

The Nigerian Communications Commission (NCC) had previously issued a directive on January 15, 2025, ordering nine banks to clear their debts by January 27, 2025, or risk losing access to their USSD codes.

While some banks have complied with the directive, Adebayo noted that a few remain non-compliant.

Adebayo emphasized that the financial stability of these operators is crucial to maintain and improve the USSD service, which plays a vital role in facilitating financial transactions for Nigerians who rely on the service.

He urged the remaining non-compliant banks to fulfill their financial obligations by the close of business today to avoid potential disruptions to the USSD service.

“A number of them are complying in line with the regulatory intervention made by the CBN and NCC.

“We still have a few hard debtors who haven’t complied, but when the time comes, according to the protocol of that circular, we are going to disconnect,” Adebayo said.

The President of the Association of Telecoms Companies of Nigeria, Tony Emoekpere, in a conversation with PUNCH on Monday, did not provide specifics on the matter.

However, he stated, “There were about nine indebted banks, but I don’t have the details now on how many of them have settled. We would have to wait and get updates from the operators.”

In a memo dated December 20, the CBN and the NCC set a deadline of December 31, 2024, for banks to settle 85% of their outstanding invoices from as far back as February 2022.

However, certain lenders challenged these regulatory directives, prompting the NCC to publicly disclose the names of the nine indebted banks.

The issue has gained significant attention due to the widespread use of USSD for mobile banking transactions in Nigeria, particularly among those without internet access.

According to CBN data, USSD transactions between January and June 2024 amounted to 252.06 million, with a total value of N2.19 trillion.

FURTHER READING

- Mojisola Meranda Assumes Office as Lagos Assembly Speaker Amid Heightened Security

- Amotekun Security Arrest Man For Power Cable Vandalism in Epe Community (VIDEO)

- Kidnappers Invade Abuja Community, Abduct Family of Four, Two Others

This represents a notable shift from the previous year, which saw 630.6 million transactions worth N4.84 trillion conducted via USSD.

As USSD has transitioned from its original purpose of facilitating telecom services such as airtime purchases to becoming a critical tool for banking services

Click here to watch video of the week

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at ekohotblog@gmail.com. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611