News

BREAKING: FG Begins Legal Battle Against Binance Over Tax Fraud

Eko Hot Blog reports that the federal government has filed a criminal charge against Binance, a popular cryptocurrency platform, for “tax evasion”.

According to The Cable, the charge was filed before the federal high court in Abuja on March 25 by the Federal Inland Revenue Service (FIRS), according to a statement on Monday.

Editor’s Picks

-

BREAKING: Detained Binance Executive ‘Escapes’ From DSS Custody

-

State Police: Why I will Not Submit Memoranda To FG – Seyi Makinde

-

Abductors Of Edo PDP Chairman Demand N500 Million Ransom

The FIRS said the move is aimed at upholding fiscal responsibility and safeguarding the economic integrity of the country.

Binance

The lawsuit, designated as suit number FHC/ABJ/CR/115/2024, “implicates Binance with a four-count tax evasion accusation.”

“Joined with the crypto company as second and third defendants in the suit are Tigran Gambaryan and Nadeem Anjarwalla, both senior executives of Binance currently under the custody of the Economic and Financial Crimes Commission (EFCC),” the statement reads

The FIRS said the charges levied against Binance include non-payment of value-added tax (VAT), company income tax, failure to file tax returns, and complicity in aiding customers to evade taxes through its platform.

More so, in the suit, the federal government also accused Binance of failing to register with the FIRS for tax purposes and contravening existing tax regulations within the country.

“One of the counts in the lawsuit pertains to Binance’s alleged failure to collect and remit various categories of taxes to the federation as stipulated by Section 40 of the FIRS Establishment Act 2007 as amended,” the agency said.

“Section 40 of the Act explicitly addresses the non-deduction and non-remittance of taxes, prescribing penalties and potential imprisonment for defaulting entities.”

The FIRS also detailed specific instances where Binance purportedly violated tax laws, such as failing to issue invoices for VAT purposes, thus obstructing the determination and payment of taxes by subscribers.

Citing the Act, the tax body said “any company that transacts business in excess of N25 million annually is deemed by the Finance Act to be present in Nigeria”.

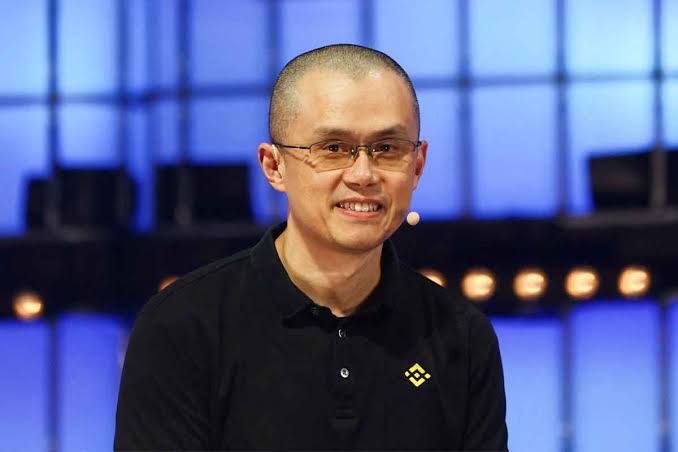

File image of Binance Co-founder, Changpeng Zhao

“According to this rule, Binance falls into that category. So, it has to pay taxes like Company Income Tax (CIT) and also collect and pay Value Added Tax (VAT),” the statement further reads.

Further Reading

-

SSANU, NASU End 7 Days Warning Strike, Resume Today

-

Hardship: Dangote Begins Distribution Of N15bn Food Aid For Nigerians

-

Historic Dodan Barracks Comes Back To Life As FG Begins Renovation

“But Binance did not do this properly. So, the company broke Nigerian laws and could be investigated and taken to court for this infraction.”

The agency said it remains resolute in its commitment to ensuring compliance with tax regulations and combating financial impropriety within the cryptocurrency sector.

Click To Watch Our Video Of The Week

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at ekohotblog@gmail.com. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611