Business

Kano State Revenue Service’s Make Aggressive Plan to Tackle Tax Defaulters

The Kano State Government has announced its intention to prosecute all tax defaulters in 2025 as part of a comprehensive reform in tax administration.

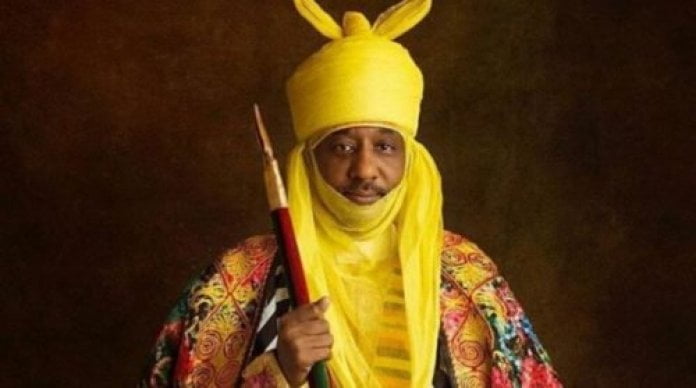

Eko Hot Blog reports that Zaid Abubakar, the Executive Chairman of Kano State Internal Revenue Service, made this declaration during a presentation at a retreat for top government officials.

EDITOR’S PICK

- Nollywood Actress, Laide Bakare Bags Doctorate Degree

- Sophia Momodu Joins ROHL: Fans Excited, Anticipate Drama in Season 3

- Nigeria Army Promotes 108 Generals

At the ongoing retreat in Kaduna, Kano State Internal Revenue Service Executive Chairman Zaid Abubakar disclosed the government’s target of generating over N20 billion in revenue each quarter of 2025.

This ambitious goal stems from significant improvements in the agency’s performance during the third and fourth quarters of 2024, following Governor Abba Yusuf’s decision to restructure the revenue service.

The governor’s move to overhaul the management structure, leading to Abubakar’s appointment, has demonstrated positive outcomes for the revenue service.

The statement added that the governor would commission a new tax collection model to ensure effective reforms in revenue generation.

The model, he said, was expected to increase revenue generation for the 2025 fiscal year substantially.

Click here to watch our video of the week:

Advertise or Publish a Story on EkoHot Blog:

Kindly contact us at ekohotblog@gmail.com. Breaking stories should be sent to the above email and substantiated with pictorial evidence.

Citizen journalists will receive a token as data incentive.

Call or Whatsapp: 0803 561 7233, 0703 414 5611